Mergers and acquisitions do not have to destroy shareholder worth, despite evidence to the contrary

Like a second marriage, mergers and acquisitions (M&A) is paradoxical – hope triumphs over experience. This is not surprising when multiple studies show that 50 to 75 per cent of M&A destroys value for the acquirer’s shareholders. Marakon’s research both supports and refutes this received wisdom. While acquisitiveness does not necessarily lead to exemplary performance, exemplary shareholder return performers show a clear propensity to use M&A to execute their strategy.

It has been widely acknowledged by executives that it is easy to get carried away by the adrenaline rush of M&A. Caught up in the excitement of deal-making and urged on by advisors who say you must buy or be bought, acquirers often: Select the wrong target, rely on market multiples to determine price and overpay, become distracted by post-deal integration and so neglect their pre-existing businesses.

Experience suggests this does not have to be the case. M&A can actually create substantial value for an acquirer’s shareholders. We find five common characteristics distinguishing the most successful acquirers.

- Exemplars use M&A as a means to accelerate a strategy versus a strategy in its own right.

- The strategy itself provides the criteria through which to evaluate targets (or divestments).

- Exemplars use a series of transactions (or pathways) versus one “bold move”.

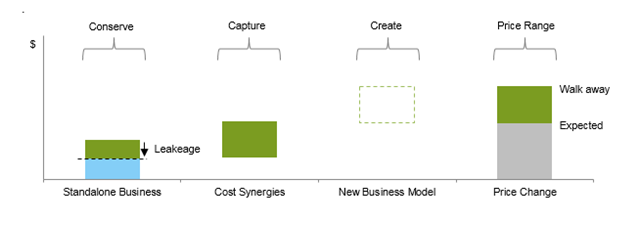

- Exemplars focus on the source of premium recapture versus market multiples when screening targets, and setting the “walk away price”.

- Exemplars have exceptional M&A discipline (value capture planning, negotiation, integration).

Marakon’s clients often use our three-prong framework – conserve, capture, create – to ensure the value delivery plan is clear and properly grounded before entering into any transaction. Acquirers must be able to conserve the value of the business being acquired, capture the value of synergies, and create new value from a new business model going forward. Exemplars focus on delivering all three elements of the framework in a way that doesn’t favour one over another.

Economics and organizational discipline can triumph over ego and emotion to ensure that M&A can be a value-creating device to accelerate strategy execution.