Introduction

Breaking up is back in favor. Recent examples in the US include ITT, Motorola, Fortune Brands, Marathon Oil, Genworth, Sara Lee and just recently, El Paso. The results have generally been quite positive. For example, ITT’s shares jumped 11% on the breakup announcement, creating roughly $1B in value. This leads to two interesting questions:

- Do pure plays really outperform diversified companies over time?

- Why did the market value of the same ITT people, assets, products and customers increase by $1B simply by announcing the breakup of the company?

To answer the first question, Marakon recently analyzed the S&P 500 to compare historical and expected performance of pure plays to diversified companies. To identify pure plays, we created a diversification index based on the North American Industry Classification System (NAICS). A company with revenue 100% concentrated in the first 4 digits of the code was defined as a pure play, while companies with revenue in two or more segments were classified as diversified. Somewhat to our surprise, 283 of the 500 companies were pure plays, 57% of the total. The remaining 43% were classified as diversified companies with roughly 18% having minimal diversification, mostly into one related industry, while 25% had diversified into multiple industries.

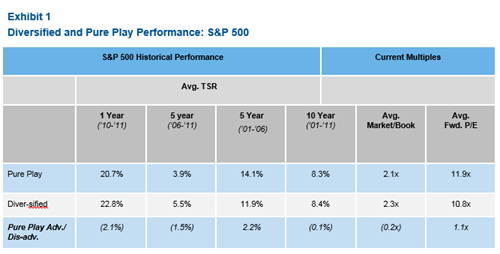

To see how the two groups fared historically, we compared the total shareholder returns (TSR) of the pure plays and diversified companies over the last year, the previous two five-year periods and the last 10 years. As can be seen in the left side of Exhibit 1, the diversified companies posted better TSRs in the past one and five years (probably due to their reduced risk profile during the recession) while the pure plays outperformed in the 2001 – 2006 period when growth was valued more highly than risk; over the 10-year period, the performance was nearly identical.

We then calculated price/earnings (P/E) using 2012 analyst estimates of earnings and market/book ratios for the two groups to get a sense of how investors expect the two groups to perform. As can be seen on the right side of Exhibit 1, the results are mixed: pure plays trade at a 10% higher P/E ratio and at a 10% lower market/book ratio. Since P/E ratios are more sensitive to growth than market/book ratios, this makes sense given the recovery in the world economy. In summary, the answer to the first question appears to be no – the data doesn’t show pure plays outperforming diversified companies over time.

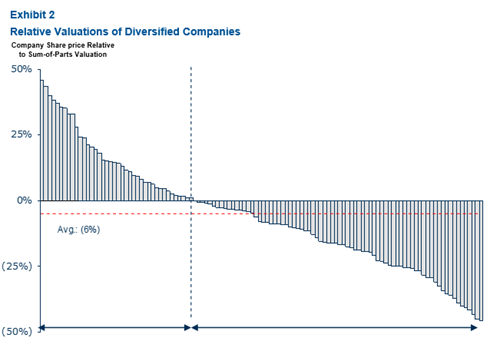

The conventional answer to the second question is that ITT’s stock was subject to a conglomerate discount that was eliminated by the breakup. The size of a conglomerate discount can be measured by comparing the market value of the company (the whole) to the value of its businesses (sum of the parts). While the former is observable, the latter must be estimated, usually using comparable multiples. We did this by using the average P/E multiple for each segment in which a diversified company participated to estimate the sum of the parts and divided it by the value of the whole company. As can be seen in Exhibit 2, simply looking at the averages in Exhibit 1 hides a very important message: there is a very large variation in whole vs. sum of the parts. On average, diversified companies trade at a 6% discount to the sum of the parts, not too different than the 10% differential in P/E ratios noted in Exhibit 1. However, roughly one-third of the companies command a “conglomerate premium” of up to 40% while the other two-thirds trade at a discount to the sum-of-parts valuation that also ranges up to 40%.

So while the average performance of the two groups is similar, some diversified companies have figured out how to materially outperform the pure play benchmark while others have materially underperformed. From management’s standpoint, the key questions posed by our research are what causes the discount in the first place and what can management do to command a premium and thus outperform pure plays?

With respect to the discount, most analysts point to a variety of causes that, in general, can be grouped into two broad assertions:

- Market Preferences: Many critics of diversification argue that investors simply prefer to create their own portfolios using pure plays rather than buy a fixed weight portfolio and also find pure plays easier to value accurately due to greater information transparency.

- Management Challenges: They also argue that large diversified companies such as Citigroup or multi-industry companies like ITT are simply too complex, too unwieldy and lack the focus necessary to be managed as effectively as pure plays so they will almost always underperform and command lower multiples.

With respect to the first assertion, market preferences definitely exist and are no doubt responsible for a portion of the discount. While we’ve not yet discovered a way to clearly separate how much of the discount comes from market preferences vs. management challenges, we believe the impact of market preferences is smaller than most critics assert and much smaller than the discount caused by management challenges. This is partly due to the fact that there are tangible economic benefits from diversification that can partially offset any market preference discount. Our view also reflects the fact that one-third of the diversified companies we studied have figured out how to command premium multiples.

Based on our research and experience working with many diversified companies over the years, we have identified four major challenges that they must overcome to achieve parity with pure plays and have also identified three potential opportunities that diversified companies can exploit to command a premium multiple.

1Based on the constituents of the S&P 500 Index as of March 201; 2Based on 2012 estimates; average market cap from January to March 2011; 3TSR Calculated for periods ending 3/31/2010

Four Major Challenges

In order to make the whole worth the sum of the parts, management must first ensure that each business in its portfolio is worth at least as much as it would be if it were a stand-alone business, what we refer to as ‘pure play parity’. Achieving this requires overcoming four distinct disadvantages that diversified companies have vs. pure plays:

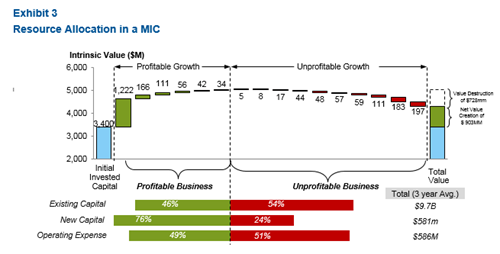

- Resource allocation disadvantage – Pure plays are not subject to the “cross-subsidies” that are often found in diversified companies. A cross-subsidy occurs when a profitable, growing business doesn’t receive the funding it needs to maximize its value because resources are allocated to businesses that either destroy value or have less value creating potential. This usually happens when the corporate center is actively managing earnings, capital and cash rather than value, so it is engaged in rationing resources across businesses rather than simply allocating capital based on value creation potential. In our experience, eliminating cross-subsidies can have a material impact on the value of a diversified company as is illustrated in Exhibit 3 where merely eliminating the value destruction would produce close to a 20% gain.

1Based on 2012 Earnings Estimates: Source: Capital IQ; Thomson One Banker; Marakon Analysis

Focus disadvantage – The top managers of pure plays are not distracted by the plethora of meetings and other activities not related to their businesses that typically occur in large, diversified companies, so they can devote more time and energy to finding profitable growth opportunities. For example, we recently surveyed how the top management of a diversified client, including heads of each business, spent their time and found that they spent 67 days in meetings of which roughly 12 days were allocated to discussing business unit strategies. It’s not difficult to imagine that if the business units were independent, operating as pure plays, those 55 additional days would have been spent more productively.

- Speed and empowerment disadvantages – The management teams of pure plays can typically make much larger decisions much faster since they don’t have to navigate the control systems set up by the much larger diversified companies. Years ago when Duracell was spun out of Kraft, Bob Kidder, Duracell’s CEO at the time, said that the biggest advantage was not having to get capital approvals in excess of $500k from the “cheese people” so that the quality and pace of decision-making improved significantly.

- Incentives disadvantage – Pure play management is rewarded only on the performance of the business whereas diversified companies deploy a mix of rewards that depend on both business unit and the company’s performance.

If management cannot overcome the four challenges so that the disadvantages are neutralized, it is easy to see how a material discount might prevail. However, most of the discount caused by these challenges is self-inflicted and can be corrected as follows:

- The cross-subsidy challenge can be overcome by adopting value-based goals and measures, as well as putting in place a better strategy and resource allocation process that actively funds all value creating growth and either fixes or eliminates value destruction anywhere it occurs.

- The focus challenge can be minimized by adopting an agenda management process that specifically allocates top management time and energy to only the highest value-at-stake issues facing the company – meaning some business units will receive significantly less and others significantly more focus.

- The speed and empowerment challenge can also be minimized by changing the nature of the control system so that business unit management has more freedom and authority. A specific major change that has worked well for our clients is to change the resource allocation process so that resources are allocated to business strategies, not individual projects.

- Finally, the incentive challenge can be minimized by re-designing reward systems to place much more emphasis on how much value is created within individual businesses and to make rewards much more variable and consequential.

While these actions might not achieve complete pure play parity, our experience is that they can get most of the way there at which point the management of a diversified company can leverage the three natural value creating opportunities that it has over pure plays.

Three Opportunities to Earn a Premium Multiple

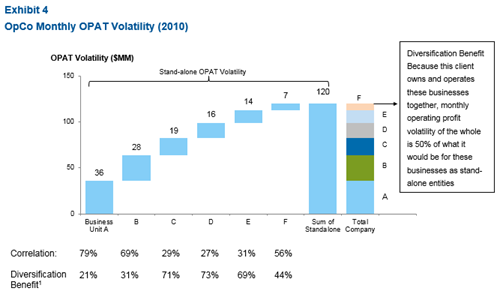

The first and most obvious opportunity to earn a premium multiple is to exploit the company’s scale and diversification. Diversified companies are usually many times larger than pure plays and because the returns from its various businesses are not perfectly correlated, the volatility of the whole is always less than the volatility of the parts (and typically lower than pure plays). This is illustrated in Exhibit 4 where we determined the ‘value volatility’ of each business unit in the company’s portfolio and its correlation so we could quantify the economic benefit from diversification.

In this example, diversification reduced the volatility by 50% over what it would be for each business as a pure play. The combination of lower volatility and larger scale creates two distinct advantages. First, management has the ability to deploy far more capital and take more risk in one of its businesses than could a pure play. As Jack Welch frequently said of GE, one of its biggest advantages is its ability to invest $500M to pursue promising ventures, something that few, if any, pure plays could afford to do without betting the company. Of course, the big bets must ultimately be economically profitable to realize the benefit of scale. Second, lower volatility means that management can borrow far more than a pure play could at the same cost of funds or will have lower cost capital at equivalent debt ratios. Because interest is tax-deductible, the present value of the additional tax shield can increase value by 5% to 15%.

The second opportunity to create value from diversification is to find and exploit synergies. Since the word synergy has been overused and discredited in some circles, we need to define it carefully: synergy is an increase in revenue and/or a reduction in costs or assets that is driven by relationships between business units and also the relationship between BU’s and the corporate center. Synergy only occurs when these relationships cause intrinsic value to increase.

Synergies between businesses are produced by shared competencies and assets. Examples of revenue synergy include bundling various products from separate businesses where the bundle produces a significant benefit to customers (Wells Fargo combining retail and small business banking) or creating a shared sales force that focuses on a specific customer segments (Dow Chemical using a dedicated marketing and sales force for auto manufacturers). Examples of cost/asset synergies include setting up shared manufacturing or distribution centers that serve several businesses where there are economies of scale, minimizing overhead costs through shared services or building a competency in lean manufacturing or Six Sigma as GE has done.

Synergies between businesses and the corporate center come from shared skills and activities that enable better, faster decision-making. Examples include the way the center designs organizational structure so it can get the balance right between centralization and decentralization, development of a common vocabulary and streamlined decision processes, building best-in-class management information systems and talent management activities. Danaher’s “Danaher Business System” (an integrated system which includes lean Six Sigma type tools, goals and measurement standards, talent management and strategic decision-making processes) is a great example of synergy creation across BUs and between any given BU and the center.

The third opportunity is to create value through superior portfolio management. Owning a portfolio of businesses offers the potential for management to make both profitable acquisitions and divestments. The test of whether an acquisition will create value is the ability of the acquirer to find and exploit combination benefits that more than offset the control premium that must be paid to do the deal. Combination benefits can come from cost, revenue and balance sheet synergies, as well as from deploying superior management capabilities. While most acquisitions do not create value for the acquirer (the market for corporate control is quite efficient), we found that many companies in the top quartile of shareholder performance are serial acquirers implying that many diversified companies have developed competencies in doing profitable deals.

Over the years, ITW Corporation has been one of these exemplars. From a small base in machine tools, it has expanded individual businesses through bolt-on acquisitions where management can reduce costs and then provide new product processes plus leverage its international network to grow revenue. It has also periodically added new businesses to the portfolio that provide a platform for new bolt-on growth.

Besides building a competency in acquisitions, diversified companies have the opportunity to create additional value from divestments. The test of a profitable divestment is whether the proceeds net of all costs and taxes exceed the value of the business in the portfolio. A key element of any divestment decision is deciding whether the company is the best natural owner of a particular business (e.g., determining whether another company might have much more synergy potential). Private equity firms may well be the exemplars of profitable divestment, in large part because their business model depends on both buying and selling.

As for the potential size of the value and multiple impacts these three opportunities can produce, we believe the upside is on the order of 25% to 50%, an estimate that is borne out by the whole vs. parts analyses we’ve seen and conducted. However, if not managed well, each of the three has the potential to destroy significant value. Despite lower volatility, large bets and high debt ratios can turn out badly, costly synergies can be pursued that don’t deliver tangible economics and many a company has faltered by overpaying for ill conceived acquisitions. Taken together, if the three ‘magnifiers’ turn negative, they can easily explain the 40% discounts seen in Exhibit 2.

Conclusion

As the data in the first two exhibits suggest, conglomerate discounts are real and large enough to justify a breakup strategy. As noted, however, we don’t believe the discounts are caused by structural market preferences but are primarily caused by how well the company is managed over time. Convincing investors to pay a premium multiple can be achieved by:

- Importing the best practices from pure plays and the financial markets to ensure all businesses achieve at least value parity with pure plays. Adopting the practices outlined in the section “Three Opportunities to Earn a Premium Multiple” would go a long way toward achieving this.

- Leveraging the scale and lower volatility that comes with diversification to make profitable, large bets and to lower capital costs.

- Exploiting cross BU and center-BU synergies that create tangible value. This requires imposing a clear economic test to decide whether the synergies really exist and how much can be invested to realize them.

- Developing the capabilities to create value by both acquiring and, when necessary, divesting businesses. An acquisition will be economically profitable only when the value of combination benefits clearly exceeds the control premium. Divesting will be economically profitable only when the net proceeds clearly exceed the value of the business within the portfolio.

Equal to (1-correlatation); Source: Client Internal Data